Let’s talk about a secret. Your money can grow all by itself. It doesn’t need magic. It needs a simple math rule called compound interest. This is the silent engine behind every great fortune in America. It’s how ordinary people build real wealth building power. This guide will show you how does compound interest work in plain English. We’ll answer why is compound interest important for your future. You’ll see it’s not just for the rich. It’s for anyone with a savings account and a dream. Get ready to meet your money’s most powerful friend.

Compound Interest Explained: A Simple Definition

Compound interest is often called interest on interest. Here’s the simple idea. You put money in a bank. The bank pays you interest. Next month, they pay you interest on your original money AND on the interest you just earned. Your money starts growing a little faster each time. This process creates exponential growth. It’s the miracle of compound interest everyone talks about.

Think of your initial principal as a seed. Compound interest is the rain and sun that helps it grow into a tree. Then that tree drops more seeds. Soon you have a whole forest from one seed. This is the core of financial growth. It answers the question “What is the miracle of compound interest?” It’s not magic. It’s math working for you over time.

How Compound Interest Works: The “Snowball Effect” in Action

The best way to picture this is the snowball effect. Imagine rolling a tiny snowball down a big hill. It starts small. As it rolls, it picks up more snow. It gets bigger. The bigger it gets, the more snow it picks up. Soon it’s a giant ball. That’s how compound interest works. Your money is the snowball. Time is the hill. The longer it rolls, the bigger it gets without you doing more work.

Let’s see a real example. You save $100 a month. Your account earns 7% interest. In year one, you earn interest on your $1,200. In year two, you earn interest on your $1,200 PLUS the interest from year one. This is accumulated interest in action. After 30 years, you won’t just have your saved $36,000. You’ll have over $100,000. The snowball effect did most of the heavy lifting. This is the power of starting early.

Compound Interest vs. Simple Interest: A Clear Comparison with Examples

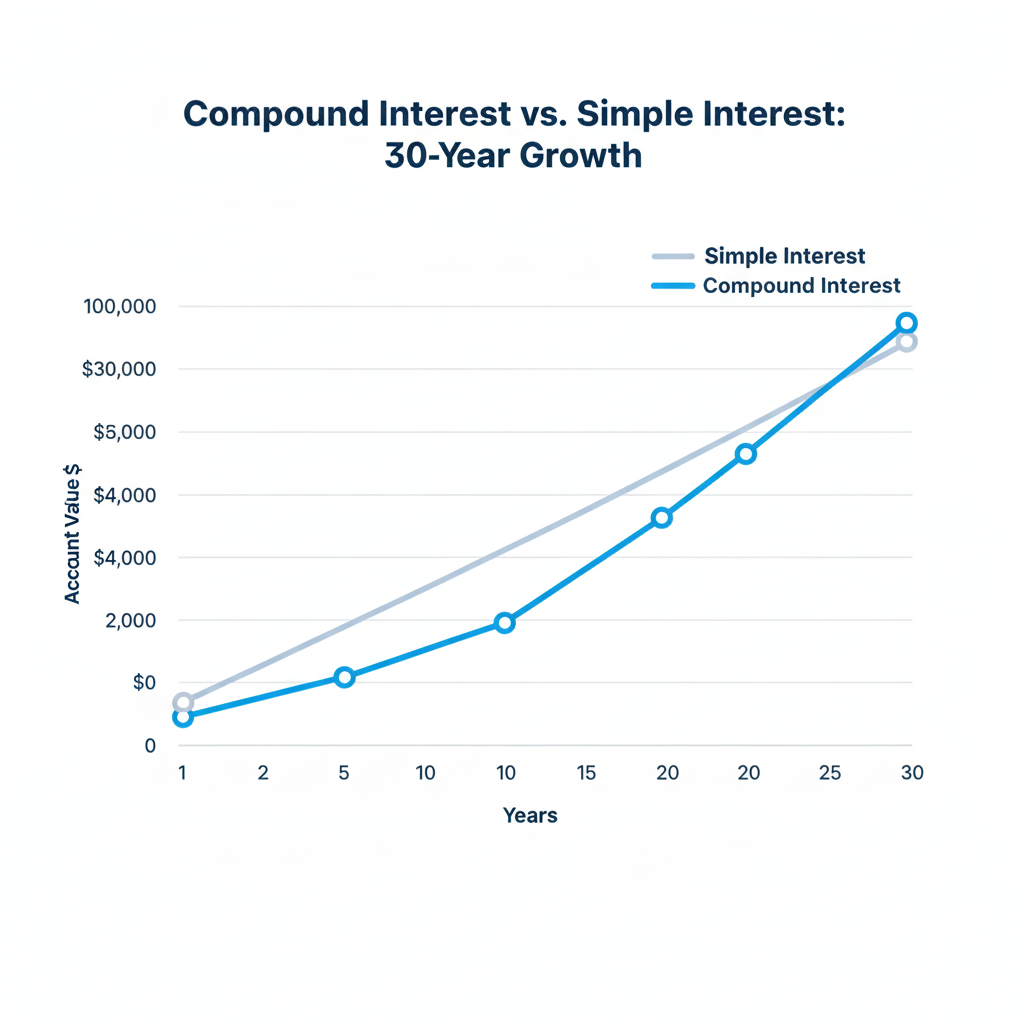

Many people ask about compound interest vs simple interest. It’s the most important money question you can learn. Simple interest only pays you on your first deposit. It’s linear growth. A $10,000 investment at 5% simple interest gives you $500 every year. It’s predictable but slow. It doesn’t help much with building wealth over a lifetime.

Compound interest is different. It’s exponential. That same $10,000 at 5% compounded gives you $500 in year one. But in year two, you get 5% on $10,500. That’s $525. In year three, you get 5% on $11,025. See the difference? The money grows faster each year. Look at this table. It shows the gap over 20 years.

| Year | Simple Interest Balance | Compound Interest Balance |

|---|---|---|

| 1 | $10,500 | $10,500 |

| 10 | $15,000 | $16,289 |

| 20 | $20,000 | $26,533 |

The compound interest account is worth $6,533 more. This is why all smart retirement savings plans use compounding. It’s the engine for long-term growth.

The Math of Growth: How to Calculate Compound Interest

You might wonder how to calculate compound interest. The formula looks scary but it’s logical. The compound interest formula is A = P (1 + r/n)^(nt). Let’s break that down. ‘A’ is the future amount of money. ‘P’ is your initial principal. ‘r’ is your annual interest rate. ‘n’ is the number of compounding periods per year. ‘t’ is the number of years your money grows.

Here’s a compound interest for beginners example. You invest $5,000 (P) at 6% annual interest (r). It compounds monthly (n=12) for 10 years (t). Plug it in: A = 5000 (1 + 0.06/12)^(12*10). You can use a compound interest calculator online. The answer is about $9,110. Your $5,000 nearly doubled because of compounding. Knowing this formula shows you the levers. Save more money (P). Get a better rate (r). Start sooner (t). This is how to build wealth over time.

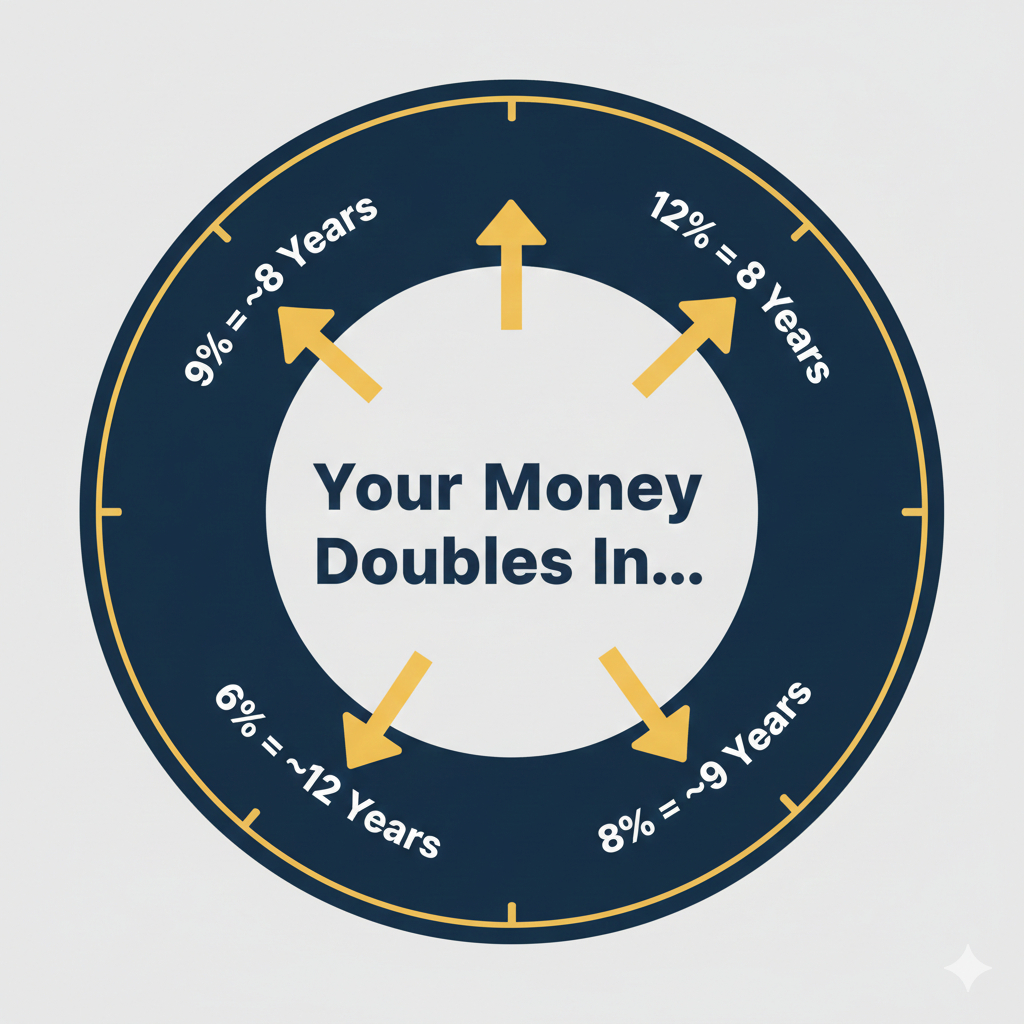

The Rule of 72: Your Quick Mental Shortcut

For a fast answer, use the Rule of 72. It’s a brilliant trick. Want to know how to double your money? Divide 72 by your interest rate. The answer is the years needed to double. An investment at 8% takes about 9 years to double (72 ÷ 8 = 9). At 4%, it takes 18 years. This shows why a higher return matters so much. The Rule of 72 proves the power of starting early. An extra few years can mean double the money.

Compounding Frequency: Why “When” Your Interest is Paid Matters

People often ask “how often is interest compounded?” The answer changes everything. Interest can be added yearly, monthly, or daily. More frequent compounding means faster growth. Your money doesn’t wait as long to start earning on its earnings. This detail separates good accounts from great ones.

Think of two savings accounts. Both have a 5% rate. Account A compounds interest annually. Account B compounds daily. On a $10,000 deposit, Account B will give you a few extra dollars each year. Over 30 years, that small difference compounds into thousands. This is why you must check the APY (Annual Percentage Yield), not just the rate. The APY includes the compounding periods. It tells you the true investment returns you will get.

The Powerful Benefits and Potential Drawbacks of Compound Interest

Let’s talk about the benefits of compound interest. Its greatest power is fighting inflation. Prices go up every year. Your money buys less. This is wealth erosion. But compound interest can grow your money faster than prices rise. It protects your purchasing power. It also creates passive income. Your money works so you don’t have to. This is key for retirement savings.

But compound interest has two sides. It works against you with debt. Credit cards use daily compounding on high rates. A small debt can balloon. The other drawback is it needs time. If you take money out often, you break the cycle. The snowball effect stops. To win, you must use compounding for savings and avoid it for debts. A good financial advisor for compounding can help you plan this balance.

Harnessing the Power: Best Accounts & Investments for Compounding

So, what are the best accounts for compound interest? Start with a high-yield interest-bearing account for your emergency fund. Look for the highest APY. For long-term growth, use retirement accounts. A 401(k) or IRA is perfect. Taxes don’t touch the growth each year. This lets compound interest run at full speed for decades.

For bigger goals, consider a brokerage account with low-cost index funds. These funds own hundreds of companies. You get the compound interest of the entire American economy. Here is a simple table to compare your main options for building wealth.

| Account Type | Best Use | Key Feature for Compounding |

|---|---|---|

| High-Yield Savings | Emergency Fund | Safe, FDIC insured, compounds daily |

| 401(k) / IRA | Retirement | Tax-advantaged, compounds without tax drag |

| Brokerage Account | General Investing | Compounds with market growth, more risk |

Your Compound Interest Strategy: Key Rules to Start Growing Wealth Now

Your strategy starts today. The first rule is to begin. Open an account now. The second rule is consistency. Set up automatic transfers every month. This feeds the snowball effect. The third rule is patience. Do not interrupt the compounding cycle. Let the accumulated interest keep working.

Finally, educate yourself. Learn about investment returns and cost of living. Understand inflation. Talk to a tax advisor or financial advisor to personalize your plan. Remember the words of Albert Einstein. He reportedly called compound interest “the eighth wonder of the world.” He who understands it, earns it. He who doesn’t, pays it. You now understand it. Go and earn it. Start your journey of wealth building today. Your future self will thank you.

Leave a Reply